Increase Investment Earnings

Build your real estate portfolio today.

Rigorous review process. Experienced investment team. Unparalleled investor support.

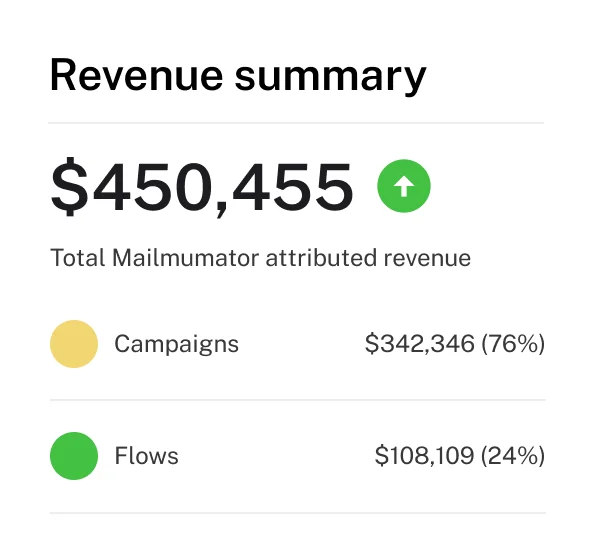

Revenue

$200.000K

Investment Portfolio

Invest with Lerteco Asset

Confirm Your Accreditation

Only accredited investors can invest in deals available on the Marketplace. Accreditation requirements are outlined by SEC.

Create an Investing Account

You’ll need an Investing Account to submit an offer. We recommend you set up an account before you submit your first offer by following the registration button below and register.

Watch Orientation

Designed for the newest members of our investor community, this brief video outlines what we think you need to know to start building your real estate portfolio.

Find a plan and Make Your First investment

You’re now ready to find a suitable investment plan that aligns with your investing goals. Review project details, perform due diligence, and make your first offer.

Learn about the Marketplace

How does Lerteco Asset review deals?

Every deal on the Lerteco Asset Portfolio undergoes our objective investment screening process. Rigor and transparency are at the core of our review process. Lerteco Asset Capital’s FINRA-licensed, experienced team of real estate professionals conducts extensive screening for both sponsors and investment opportunities before listing them on the Lerteco Asset’s Portfolio.

What kind of Investment Plan are on the Portfolio?

Lerteco Asset’s Portfolio offers a variety of investment plans across property types, from multifamily to self-storage to industrial. Each deal has its own unique potential and risks based on the individual business plan. Read about our outlook for each property type on the portfolio.

What information is provided about the investment plans?

To help you make informed decisions, we provide in-depth information and insights for each investment plan, including sponsor presentations and webinars, key deal assumptions and risks, details on the business plan and financials, return structures, and much more.

Compare Your Investment Options

Investing in commercial real estate can be a part of building a healthy portfolio. But there isn’t a one-size-fits-all way to invest. Lerteco Asset makes it easy to find the approach that’s right for you.

- About Individual Properties.

Individual Properties

Our platform bridges the gaps between Investors, ensuring they make the most out of their investment. Invest directly in individual real estate opportunities.

Access Nationwide Deal Flow

We work with some of the nation’s top real estate sponsors to bring you a wide range of carefully curated deals across various property types, regions, and strategies.

Tap into comprhensive insights

We provide you with exceptional detail and direct communication with sponsors, so you can make informed decisions.

Build a custom portfolio

Curate a tailored real estate portfolio by selecting individual deals that support your unique investing objectives.

- About Diversified Funds

Quick and easy access into a diversified portfolio.

Our platform bridges the gaps between Investors, ensuring they make the most out of their investment. Invest directly in individual real estate opportunities.

Leverage real estate professionals

Lerteco Asset Advisors funds are constructed and managed by Lerteco Asset Advisors’ in-house real estate team, while sponsor funds are led by the sponsor and typically focus on the firm’s property or regional experience.

Construct your portfolio faster

Spend less time and effort building your real estate portfolio while potentially gaining exposure to multiple property types, sponsors, and regional markets.

Get more with one investment

Funds require a minimum investment similar to individual deals, yet offer exposure to multiple projects, helping potentially diversify your investment.

Start Investing Today!